All Categories

Featured

Table of Contents

A level term life insurance coverage policy can offer you satisfaction that individuals that depend upon you will have a fatality advantage during the years that you are preparing to sustain them. It's a method to aid take treatment of them in the future, today. A degree term life insurance policy (in some cases called level premium term life insurance coverage) plan supplies protection for a set number of years (e.g., 10 or two decades) while keeping the premium repayments the very same for the period of the plan.

With degree term insurance policy, the expense of the insurance coverage will stay the very same (or potentially lower if rewards are paid) over the regard to your plan, typically 10 or 20 years. Unlike long-term life insurance coverage, which never expires as lengthy as you pay premiums, a level term life insurance coverage plan will finish eventually in the future, commonly at the end of the period of your degree term.

Is Term Life Insurance Level Term the Right Fit for You?

Due to this, lots of people utilize permanent insurance policy as a stable economic planning tool that can serve many requirements. You may have the ability to transform some, or all, of your term insurance policy throughout a collection duration, usually the very first ten years of your plan, without requiring to re-qualify for protection even if your health and wellness has changed.

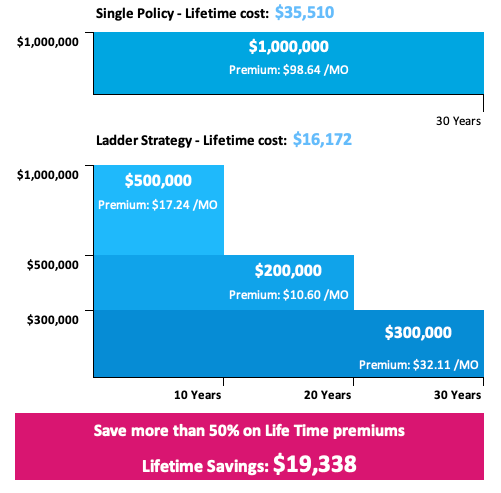

As it does, you may intend to include to your insurance protection in the future. When you first obtain insurance coverage, you may have little savings and a large home loan. Eventually, your savings will certainly expand and your home loan will reduce. As this happens, you might desire to eventually decrease your death advantage or take into consideration converting your term insurance to a permanent policy.

Long as you pay your premiums, you can relax easy recognizing that your loved ones will certainly obtain a death benefit if you pass away throughout the term. Numerous term plans enable you the capability to transform to permanent insurance policy without needing to take another health and wellness examination. This can permit you to make the most of the added benefits of an irreversible plan.

Level term life insurance policy is among the easiest paths into life insurance policy, we'll go over the benefits and downsides so that you can choose a strategy to fit your needs. Level term life insurance policy is one of the most common and standard form of term life. When you're seeking short-lived life insurance policy plans, degree term life insurance is one path that you can go.

The application procedure for degree term life insurance policy is generally very simple. You'll fill in an application which contains general personal information such as your name, age, etc in addition to a more detailed set of questions regarding your medical history. Relying on the plan you're interested in, you may have to get involved in a clinical exam process.

The short response is no. A degree term life insurance policy policy doesn't build cash value. If you're seeking to have a policy that you have the ability to withdraw or obtain from, you might check out permanent life insurance. Entire life insurance policy policies, for instance, let you have the convenience of survivor benefit and can build up cash money worth gradually, suggesting you'll have a lot more control over your benefits while you're alive.

What is What Does Level Term Life Insurance Mean? The Key Points?

Bikers are optional provisions contributed to your policy that can offer you fringe benefits and protections. Riders are a great way to include safeguards to your policy. Anything can occur throughout your life insurance policy term, and you intend to await anything. By paying simply a little bit extra a month, riders can provide the assistance you require in case of an emergency situation.

There are instances where these advantages are developed into your policy, yet they can also be available as a different addition that requires extra repayment.

Latest Posts

What Is The Difference Between Life And Burial Insurance

Final Expense Risk Insurance

Final Expense Insurance With No Medical Questions