All Categories

Featured

Table of Contents

- – What is the Advantage of What Is Level Term Li...

- – What is the Meaning of Level Term Vs Decreasin...

- – What Exactly Does Guaranteed Level Term Life ...

- – What is the Purpose of Level Premium Term Lif...

- – What Exactly is Voluntary Term Life Insurance?

- – How Does Level Premium Term Life Insurance P...

- – Discover What Term Life Insurance Level Term...

With this sort of level term insurance plan, you pay the exact same monthly premium, and your recipient or recipients would get the same benefit in the event of your death, for the entire insurance coverage period of the plan. So exactly how does life insurance policy operate in terms of cost? The cost of degree term life insurance policy will depend on your age and health as well as the term size and coverage quantity you select.

Life: AgeGenderFace AmountTerm LengthPremium30Male$500,00030$29.9930 Female$1,000,00030$43.3135 Man$500,00020$20.7235 Lady$750,00020$23.1340 Male$600,00015$22.8440 Woman$800,00015$27.72 Price quote based on prices for qualified Place Simple applicants in outstanding wellness. No matter of what protection you select, what the policy's cash value is, or what the lump amount of the death benefit transforms out to be, tranquility of mind is among the most valuable advantages associated with purchasing a life insurance plan.

Why would a person choose a plan with an every year sustainable costs? It might be a choice to take into consideration for a person that requires insurance coverage only momentarily.

What is the Advantage of What Is Level Term Life Insurance?

You can normally restore the policy yearly which offers you time to consider your choices if you desire protection for longer. Realize that those alternatives will involve paying greater than you used to. As you get older, life insurance policy premiums come to be significantly extra costly. That's why it's useful to purchase the correct amount and length of coverage when you first obtain life insurance policy, so you can have a low rate while you're young and healthy.

If you contribute essential unpaid labor to the house, such as youngster care, ask yourself what it might set you back to cover that caretaking job if you were no more there. After that, make certain you have that protection in location to make sure that your family members gets the life insurance policy benefit that they require.

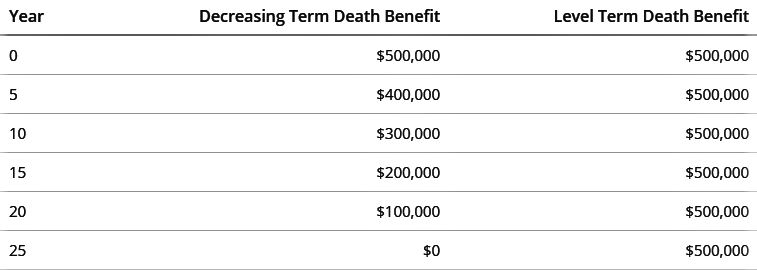

What is the Meaning of Level Term Vs Decreasing Term Life Insurance?

Does that indicate you should always pick a 30-year term length? In basic, a shorter term policy has a reduced premium rate than a much longer policy, so it's clever to choose a term based on the forecasted size of your financial obligations.

These are all crucial variables to remember if you were considering selecting a long-term life insurance policy such as an entire life insurance coverage plan. Several life insurance policy policies offer you the choice to add life insurance policy motorcyclists, think additional benefits, to your plan. Some life insurance policy plans include cyclists integrated to the expense of costs, or motorcyclists might be readily available at a cost, or have fees when exercised.

What Exactly Does Guaranteed Level Term Life Insurance Offer?

With term life insurance policy, the interaction that the majority of people have with their life insurance company is a month-to-month bill for 10 to 30 years. You pay your monthly costs and hope your family members will never ever have to utilize it. For the team at Sanctuary Life, that felt like a missed out on possibility.

Our company believe navigating choices regarding life insurance coverage, your personal finances and total health can be refreshingly basic (What is a level term life insurance policy). Our material is developed for instructional objectives only. Place Life does not back the companies, products, solutions or methods reviewed here, but we wish they can make your life a little less difficult if they are a fit for your situation

This product is not intended to provide, and must not be relied upon for tax, legal, or financial investment suggestions. People are encouraged to seed recommendations from their own tax or legal guidance. Review even more Sanctuary Term is a Term Life Insurance Policy Plan (DTC and ICC17DTC in specific states, consisting of NC) issued by Massachusetts Mutual Life Insurance Coverage Business (MassMutual), Springfield, MA 01111-0001 and used specifically with Sanctuary Life insurance policy Company, LLC.

Best Firm as A++ (Superior; Top classification of 15). The ranking is since Aril 1, 2020 and goes through alter. MassMutual has received various rankings from various other ranking firms. Place Life And Also (Plus) is the advertising and marketing name for the And also biker, which is consisted of as component of the Sanctuary Term policy and provides access to added solutions and benefits at no price or at a discount.

What is the Purpose of Level Premium Term Life Insurance Policies?

If you depend on somebody monetarily, you could question if they have a life insurance coverage plan. Learn how to discover out.newsletter-msg-success,.

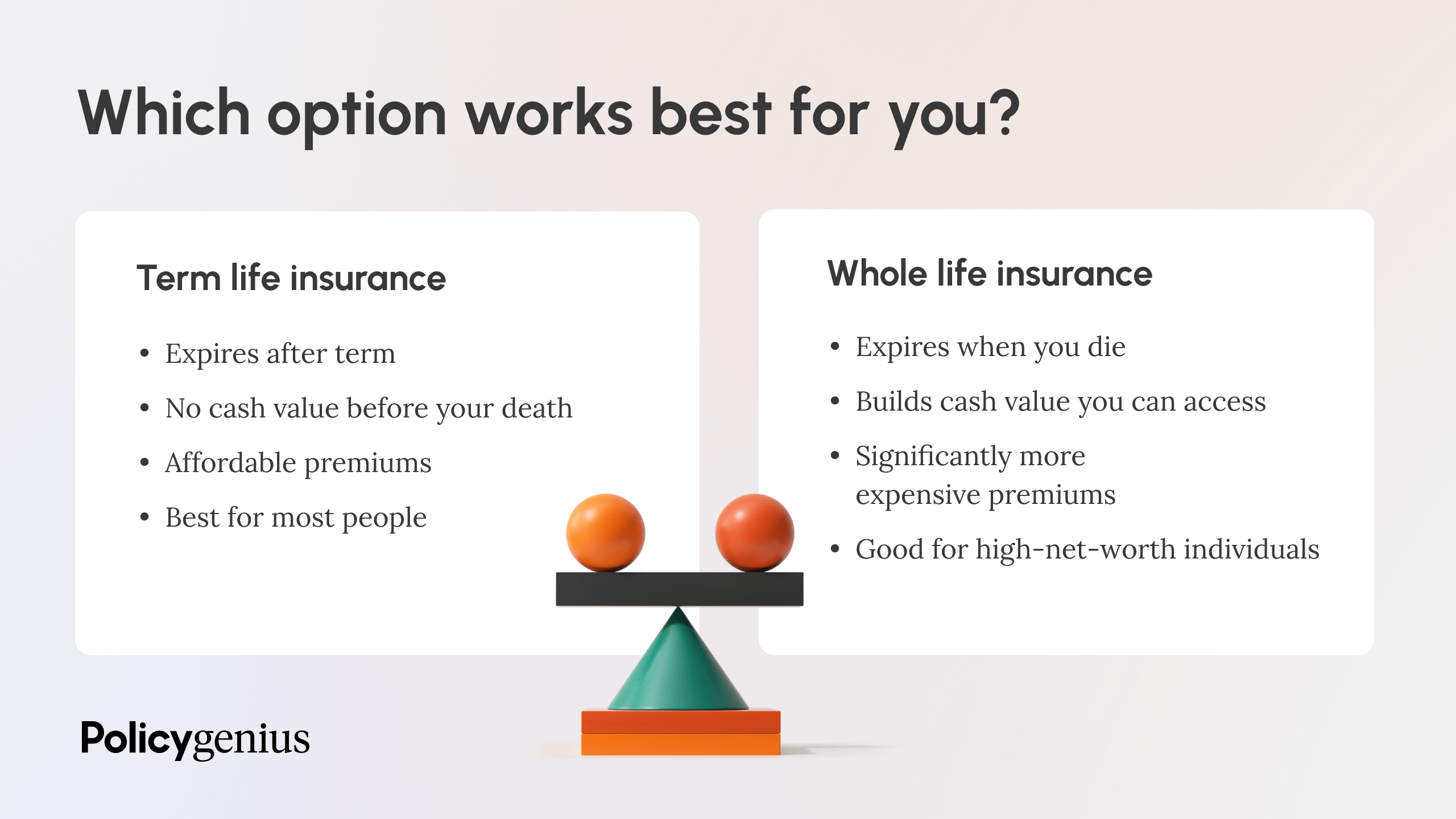

When you're younger, term life insurance policy can be a straightforward means to safeguard your enjoyed ones. As life modifications your monetary top priorities can too, so you may desire to have entire life insurance policy for its life time coverage and additional benefits that you can utilize while you're living.

What Exactly is Voluntary Term Life Insurance?

Approval is ensured no matter of your wellness. The costs won't boost once they're set, however they will certainly increase with age, so it's a good concept to secure them in early. Locate out extra about just how a term conversion works.

Words "level" in the expression "level term insurance coverage" suggests that this sort of insurance policy has a fixed costs and face quantity (death advantage) throughout the life of the policy. Basically, when individuals speak about term life insurance policy, they normally refer to level term life insurance policy. For the bulk of people, it is the easiest and most budget friendly selection of all life insurance policy types.

Navigating life insurance options can be overwhelming, especially with so many policies available. This is where working with an experienced insurance broker or agent makes all the difference. Unlike insurance agents tied to a single provider, brokers offer access to multiple life insurance options, helping you find the most suitable policy for your needs - life insurance with tax benefits through brokers. Whether it’s term life insurance for temporary coverage, whole life insurance for lifelong protection, or universal life for long-term growth, an insurance broker evaluates your unique goals and compares providers to secure the best coverage at competitive rates

For families, policies like final expense insurance, mortgage protection, and accidental death coverage offer tailored solutions to protect loved ones. Business owners can also benefit from key person insurance, ensuring continuity in the event of an unforeseen loss. With life insurance policies offering living benefits or instant coverage, brokers simplify the decision-making process and ensure your financial priorities are met.

By choosing the right insurance broker, you gain expert guidance, access to personalized recommendations, and the confidence of knowing your family or business is secure. Contact an insurance broker today to explore tailored life insurance options and secure peace of mind for the future.

How Does Level Premium Term Life Insurance Policies Compare to Other Types?

The word "term" here refers to a given number of years throughout which the level term life insurance policy remains active. Level term life insurance policy is among the most popular life insurance policy policies that life insurance service providers use to their clients as a result of its simplicity and price. It is also simple to contrast degree term life insurance policy quotes and obtain the finest premiums.

The mechanism is as follows: Firstly, choose a plan, survivor benefit quantity and policy duration (or term length). Second of all, select to pay on either a month-to-month or annual basis. If your early demise occurs within the life of the plan, your life insurance firm will pay a lump sum of death advantage to your predetermined recipients.

Discover What Term Life Insurance Level Term Is

Your level term life insurance policy expires as soon as you come to the end of your policy's term. Now, you have the adhering to options: Choice A: Remain without insurance. This option suits you when you can guarantee by yourself and when you have no financial obligations or dependents. Choice B: Get a new degree term life insurance policy plan.

1 Life Insurance Policy Statistics, Information And Industry Trends 2024. 2 Price of insurance policy rates are figured out utilizing techniques that vary by company. These rates can vary and will typically raise with age. Prices for active staff members may be different than those available to ended or retired employees. It's vital to consider all variables when reviewing the general competition of prices and the value of life insurance policy coverage.

Table of Contents

- – What is the Advantage of What Is Level Term Li...

- – What is the Meaning of Level Term Vs Decreasin...

- – What Exactly Does Guaranteed Level Term Life ...

- – What is the Purpose of Level Premium Term Lif...

- – What Exactly is Voluntary Term Life Insurance?

- – How Does Level Premium Term Life Insurance P...

- – Discover What Term Life Insurance Level Term...

Latest Posts

What Is The Difference Between Life And Burial Insurance

Final Expense Risk Insurance

Final Expense Insurance With No Medical Questions

More

Latest Posts

What Is The Difference Between Life And Burial Insurance

Final Expense Risk Insurance

Final Expense Insurance With No Medical Questions